Annuities Can Be Used to Fund Which of the Following

Purchased by the retirement fund from a South African-registered insurer in the name of the life of the retiring member. Annuities can also be used to liquidate an estate.

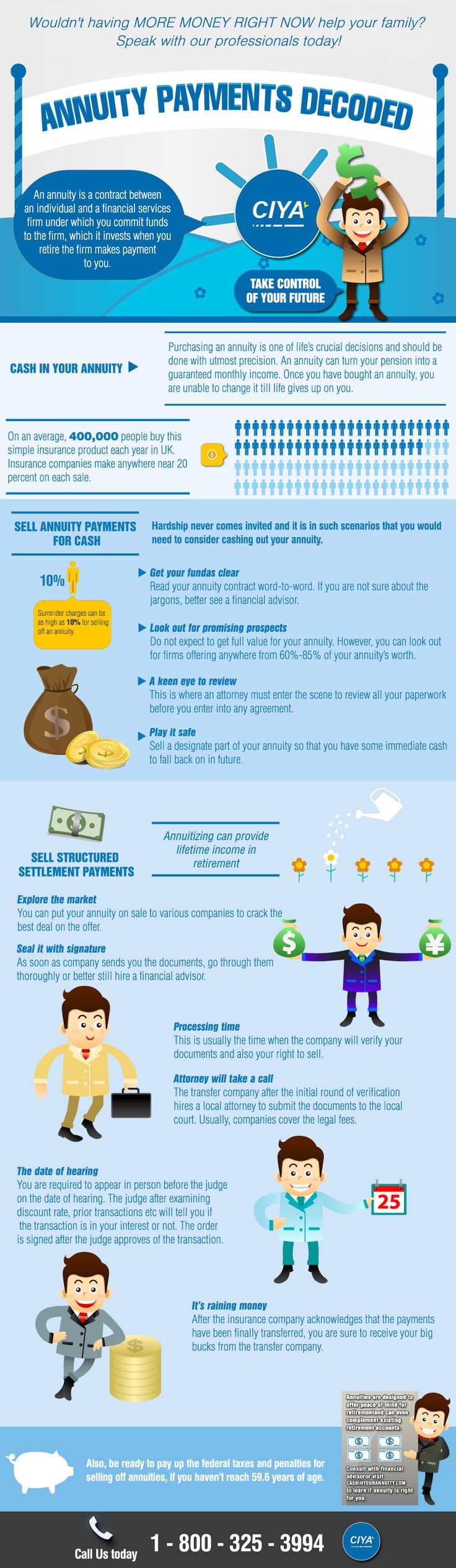

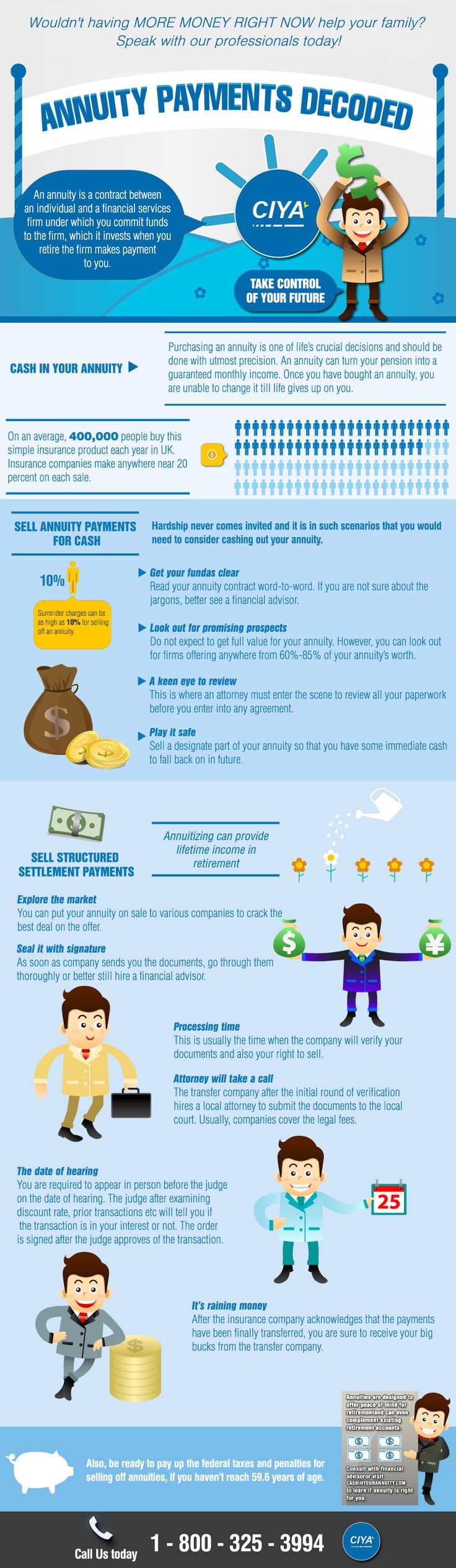

Infographic How To Buy An Annuity Step By Step Guide Annuity Annuities Lifeannuity Annuitybroker Howtobuy Infographi Annuity Budgeting Money Infographic

Purchased from a South African-registered insurer in the name of the fund.

. Annuities can be used for all of the following reasons EXCEPT. To fund non-qualified annuities investors rely on post-tax funds. Which of the following account types can not be used to fund a Registered Annuity.

All of the following are true regarding deferred annuities EXCEPT. You can fund your deferred income annuity in a number of ways including. If however you used after-tax dollars to fund your annuity called a nonqualified annuity you wont be taxed on the portion of your withdrawal that represents a return of your original principal.

Currently an annuity can be paid to a member in one of three ways. Depending on the type of annuity your money would then be used for other investments like mutual funds. To create an estate.

Variable annuity contracts allow insurers to invest your premiums in mutual funds that comprise stocks bonds and other short-term money market products called subaccounts Your rate of return depends on the performance of your subaccounts. In the case of. An annuity is often used to fund retirement and can come in a variety of types that align with different financial goals and risk tolerance.

Qualified IRA style annuities and some Non-Qualified savings style can be stretched. Annuities are contracts made with an insurance company largely as a way to plan for retirement. Unlike indexed annuities that are tied to a market index variable annuities provide a return thats based on the performance of a portfolio of.

LIFs are converted into a life annuity at age 80. Since you bought for it. An accumulation annuity is a life insurance product that allows you to accumulate savings over time that can be used to fund an income stream of annuity payments in the future.

Those are provided by life insurance. The age of the buyer of an annuity is an extremely important factor in any determination of whether that annuity is suitable. Fixed immediate annuities are invested in stocks and bonds through the insurance companys general fund and the interest rate cannot go below a certain minimum.

The present value interest factor of an annuity is a factor that can be used to calculate the present value of a series of annuities when it. The fund has a particular investment objective and the value of your money in a variable annuityand the amount of money to be paid out to youis determined by the investment performance net of. A They may be used to fund an IRA B They provide tax-deferred growth C They provide a source of retirement income D They provide an immediate source of education funds.

The SEC regulates variable annuities. You could elect to re-position this 100000 into a combination fixed annuity with long term care benefits for an 8 year benefit period. An annuity for example might continue to pay your spouse after your death.

Money in a variable annuity is invested in a fundlike a mutual fund but one open only to investors in the insurance companys variable life insurance and variable annuities. To fund a childs education D. Proceeds from the sale of stocks bonds a home or a business.

LIFs have a maximum withdrawal limit. The annuity can then be used to provide guaranteed lifetime income tot he annuitant. Cash from a maturing Certificate of Deposit CD.

An annuity can be sold for cash or it can be passed on to a designated beneficiary. Your payout will vary depending on how much you put in the rate of return on your investments and expenses. The insurance company allows you to direct your annuity payments to different investment options usually mutual funds.

You can buy an annuity by making a one-time purchase or by contributing money to the insurance company over time. Exchanging monies accumulated in a Deferred Annuity account. To liquidate an estate C.

Death Benefit annuities guarantee a minimum rate of return to heirs. Charitable gift annuities create tax savings. 2- Which of the following statements regarding a LIF is false.

To accumulate retirement finds B. Directly by the retirement fund to the member. The annuity funds used for long-term-care costs are tax-free.

Annuities do not provide death benefits. With this approach you could leverage your 100000 cash value into 400000 to 500000 tax-free dollars that can provide you with 4000-5000 month for 8 years should you need long term care. Death benefits - Annuities are most commonly used to fund a persons retirement but they can technically be used to accumulate cash for any reason.

LIFs can be funded by transferring funds from an RRSP. Lump sum structured settlements lump sum payments from lawsuits lottery winnings or an inheritance can be used to purchase a structured settlement in the form of an annuity. If you name a beneficiary the money in your Superflex or Income Master policy can bypass estate and probate fees after your death.

Variable annuities offer riders that guarantee that your annuity value will not drop below a certain threshold even if the stock market declines and your subaccounts lose money. Annuities are financial instruments that earn interest and provide a guaranteed stream of payments over a predetermined amount of time.

Annuity Annuity Insurance Marketing Life Insurance Marketing

A Security Is The Blanket Term Used To Describe A Financial Product Most Investments That You Purchase Over A Market Or Money Market Investing Mutuals Funds

What Is An Annuity Annuity Investing For Retirement Finance Investing

No comments for "Annuities Can Be Used to Fund Which of the Following"

Post a Comment